How to Help Escrow with Loan Packaging

IMPORTANT: Loan Packaging is work that is typically conducted by an escrow company. We are not an authority and cannot speak for any escrow, bank, or state’s guidelines. This is article is meant to give an idea concerning how loan packaging generally works. Consult each receiving agency’s specific guidelines.

What’s the purpose of loan packaging?

Understanding why they package loan Documents

Imagine holding the paperwork that the borrowers just signed. You’re in the escrow office and they have requested that you ‘package the loan documents’. They provide you with an empty desk and a nearby photo copier. That stack of loan documents that was just signed is about to triple in size. Your job is now to extract certain original documents from the pile of papers, make copies of them, and distribute them into 3 different piles. The first pile is for the escrow company, then a pile for the lender, then a stack for the title company. By the end of the process, each of the piles will have some blue ink signed original, and some photocopies.

Before we begin, can you contemplate who might need what originals and why? For Instance, what does the title company do? Which important document would they need an original of? What is the banks ultimate goal in lending money? which document might they want to retain to make sure this goal happens?

1. Understand what the role of the institution in the lending process

- Lender

- Escrow

- Title

The escrow company is the neutral party that holds the money or property in trust and distributes when the conditions of the contract are met.

The title company can serve in many roles. They provide insurance to the bank and the buyer, protecting them from forgery, fraud, and liens. They also record documents (like deeds and riders) with the county.

2. Understand primary documents within a loan package

- Note (“IOU”)

- Deed of Trust (“Security Agreement” or “Lien Doc”)

- Grant Deed

- Riders

- Lending Instructions

- Escrow Contract Amendments

- Closing Disclosure (CD)

The Deed of Trust is the security instrument, it places a lien on the home to protects the bank. It gets recorded with the county. It protects the bank from a borrower running off with a large sum of money without consequence. If a borrower doesn’t pay the loan back or take care of home responsibilities like paying taxes, the bank may exercise on it’s right to foreclose on the home.

The Riders are most often addendum to the deed of trust (or note) to indicate a variation or update within the general terms of the document it is attached to. For example, a deed if trust may have a Planned Unit Development Rider (PUD) to show that the home falls within a homeowner’s association and is subject to its rules. The deed of trust riders are attached and recorded with the deed of trust.

The Grant Deed is the document signed by the seller to grant over the home to the new buyer. This document is held by the escrow company until the home is paid for according to the terms of the contract. It is recorded with county.

The Lending Instructions/Conditions are loan document instructions for the drafting and processing of a successful loan transaction. These instructions include conditions from homeowner’s insurance, to paying off credit cards, to the need for exact signatures on the loan documents. These instructions help everyone in the process carry out the terms of the lender.

Escrow Contract Agreements or Addendum are often found within atop the closing documents to satisfy the escrow’s contractual paperwork, transactional details between parties, and disclosure.

The Closing Disclosure is a government instituted mandatory form that provides full disclosure of the costs, loan, rate, and terms within a loan transaction. It is provided continually throughout the process to provide full disclosure to the borrowers of loan terms in an easily identifiable way.

3. Appropriate original signed documents received to each agency for closing

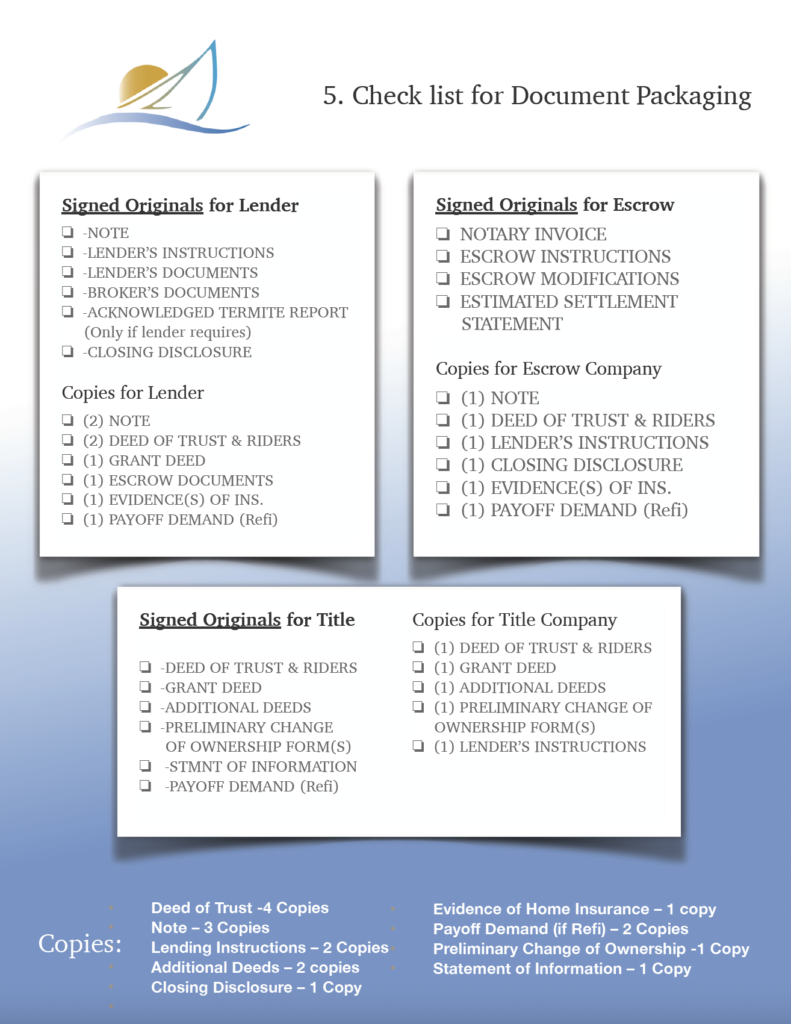

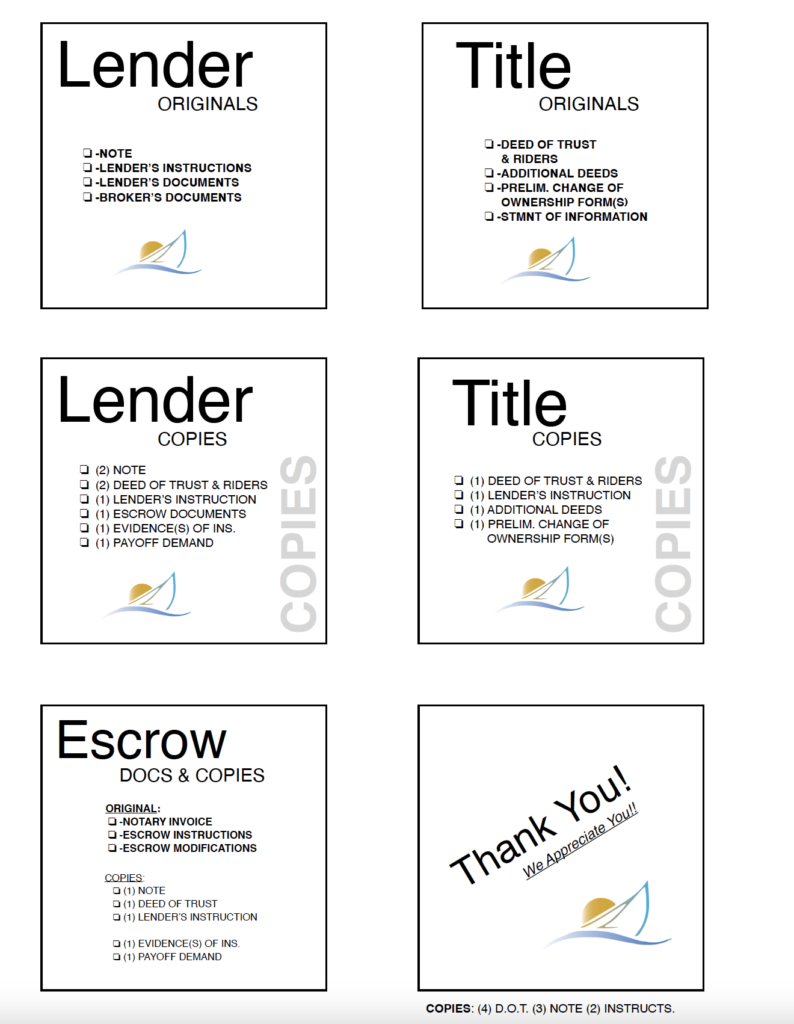

4. How to Package Loan Documents (3 stacks)

Total Copies that are made as follows:

- Deed of Trust -4 Copies

- Note – 3 Copies

- Lending Instructions – 2 Copies

- Additional Deeds – 2 copies

- Closing Disclosure – 1 Copy

- Evidence of Home Insurance – 1 copy

- Payoff Demand to current loan (if a refinance) – 2 Copies

- Preliminary Change of Ownership Form -1 Copy

- Statement of Information – 1 Copy

5. Organization checklist for document packaging

Always reaffirm packaging procedures with your escrow officer first. There may be updates along the way. Consider these helpful checklists and organizational tools. IMPORTANT: Be mindful to keep original blue ink copies safe, unaltered, and untouched. Be careful escrow officers know the originals from copies. This is important because their”True and original copy” stamps only go on the duplicate black and white copies from the copier.